- Packages -

WHAT WE DO

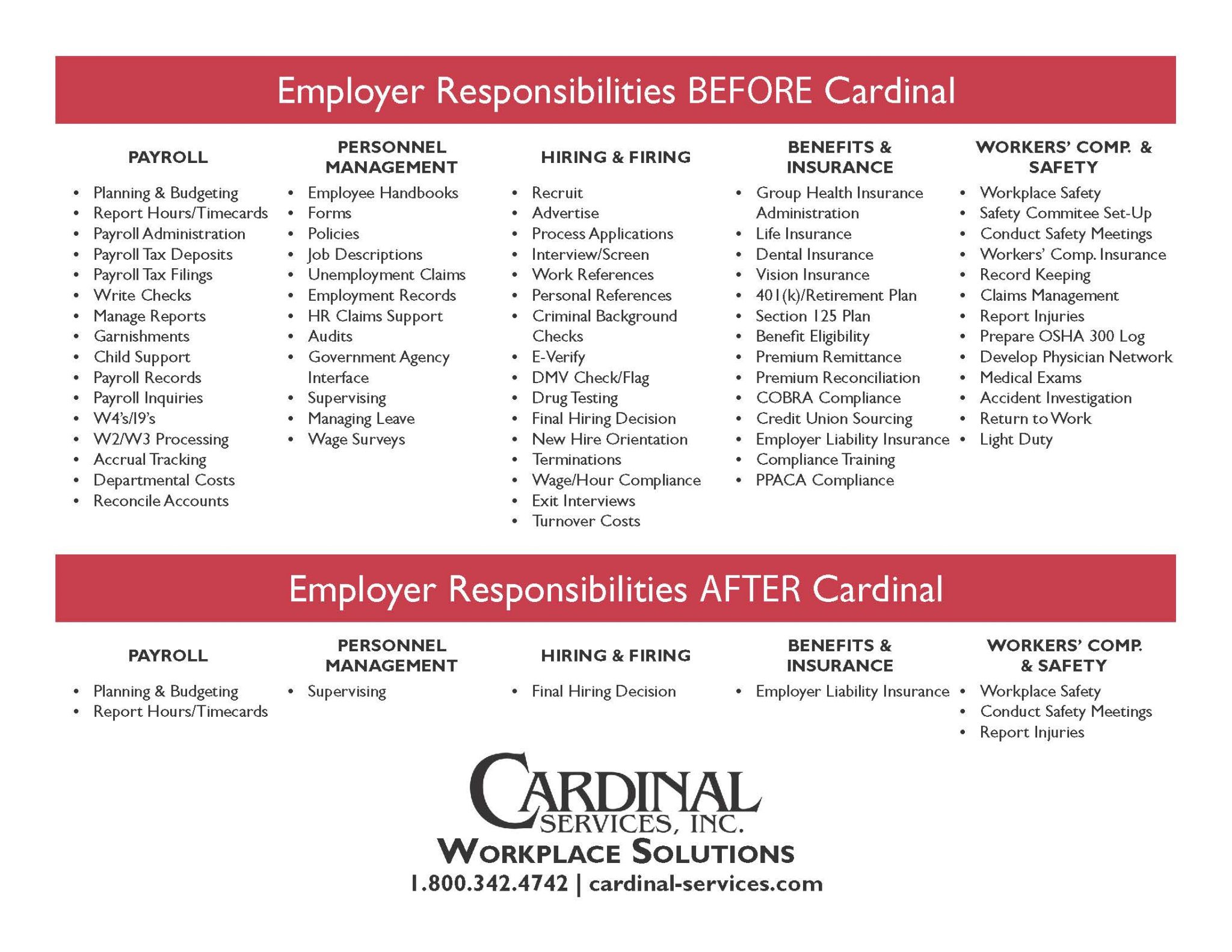

Whether you’re looking for an all-inclusive HR solution or a la carte payroll, staffing, or workers’ comp coverage, our friendly team can put together services tailored to your unique business needs.

Co-Employment

Let us handle all your employment needs, from hiring to payroll to workers’ comp and more.

Staffing

Hire right the first time! Bad hiring causes a high percentage of business failures.

Payroll

Gain relief from administrative and regulatory burdens with our payroll options.

- Team Approach -

EXPERIENCED

Since 1984, our specialists at Cardinal Services have been helping local businesses get back to doing what they do best -- while we take on the paperwork and headaches of being a business owner. Our staff has an average tenure of 10-years which shows in the range of professional solutions we are able to provide.

Co-Employment

- Cardinal becomes Employer of Record

- Workers' Comp & Risk Management

- Employee Benefits

Staffing

- Recruiting/Staffing services

- Application and Screening programs

- CRIMINAL BACKGROUND INVESTIGATIONS

- CUSTOMIZED TESTING

Payroll Only

- Quarterly and Year-end reporting

- Automatic payroll tax filing

- Experienced Specialized Team

- Time Tracking

- Recent-

HR Alerts

New Federal Overtime Rule Challenged

You might have read Cardinal’s recent Employer Alert (https://cardinalservices.com/new-federal-overtime-rule/) that the U.S. Department of Labor [DOL] is changing the minimum salary thresholds for employees that are exempt from overtime. The published deadlines for the change in salary thresholds are as follows: July 1, 2024: The salary threshold increases from $684 per week [$35,568 per […]

About this eventNew Federal Overtime Rule

Department of Labor Increases Salary Requirements for White-Collar & HCE Exemptions Implementation Deadlines: First phase on July 1, 2024 | Second phase on January 1, 2025 The U.S. Department of Labor [DOL] announced the Final Rule: Restoring and Extending Overtime Protections. The final rule amends the Fair Labor Standards Act regulations by increasing the […]

About this event2025 HSA Contributions Announced

HSA Limit Contributions Announced for 2025 The IRS announced that the annual limit on health savings account (HSA) contributions for self-only coverage in 2025 will be $4,300, a 3.6 % increase from the $4,150 limit in 2024. The HSA contribution limit for family coverage will jump to $8,550, a 3 % increase from $8,300 in […]

About this eventFive Tax-Time Employee Perks

Offering tax filing help can relieve workers’ stress and provide a unique advantage for out-recruiting the competition! Everybody hates doing taxes. Filing a tax return—whether state or federal—without some kind of help is stressful. More than half of U.S. adults who file tax returns (57%) find the do-it-yourself approach nerve-racking, according to a study conducted […]

About this eventPOLICY REVIEW 2024 | The California Privacy Rights Act

If you employ workers or do business in California, here is a brief review of the recently updated California Privacy Act. What is it? The California Privacy Rights Act (CPRA) provides comprehensive regulation of the personal information (PI) of California residents. PI includes any “information that identifies, relates to, describes, is reasonably capable of […]

About this eventGovernmental Affairs Alert: Information on the US Department of Treasury’s Financial Crimes Enforcement Network (FinCEN)

Cardinal Services continues to focus on employment-related laws, new court cases, and regulatory changes that impact our business community. While the news about FinCEN is not directly employment-related, some employers could be subject to this new reporting rule. However, the new FinCEN reporting requirement has not been well publicized, but we think it is universal […]

About this eventComing in 2024 | E-Verify NextGen

The Feds combine the eVerify and Form I-9 into one digital process. E-Verify NextGen—scheduled for incremental release in 2024—integrates the Form I-9 process with E-Verify, the federal government’s electronic employment verification system, revolutionizing the employment verification process for the business community! This new combined system from the U.S. Citizenship and Immigration Services (USCIS) will […]

About this eventDOL Issues Final Rules on Independent Contractor Classification

The U.S. Department of Labor (DOL) released a final rule on January 9th that changes the criteria for classifying independent contractors. The final rule requires companies to weigh various factors to determine whether a worker is an employee or an independent contractor. The final rule will take effect on March 11. Background to the […]

About this eventDo employers need to pay for worker commutes?

A recent memo from the Federal Office of Personnel Management has raised new questions for the private sector. New Federal guidance: On Aug. 22, 2023, the Federal Office of Personnel Management issued guidance regarding whether the Fair Labor Standards Act requires federal workers to be compensated for their commute to work. This new guidance also […]

About this event